ELCA Witness in Society: One Big Beautiful Impact

From ELCA Witness in Society:

One Big Beautiful Impact: The ELCA Witness in Society Office is working on a policy memo for the Presiding Bishop's office, detailing the full range impact to programs after the passage of the One Big Beautiful Bill Act (HR 1). In totality, over 3 million families are expected to lose SNAP assistance due to paperwork and work requirements, and we are concerned that less wealthy states may be forced to drop out of SNAP entirely if they can not make new required cost expectations in late 2027.

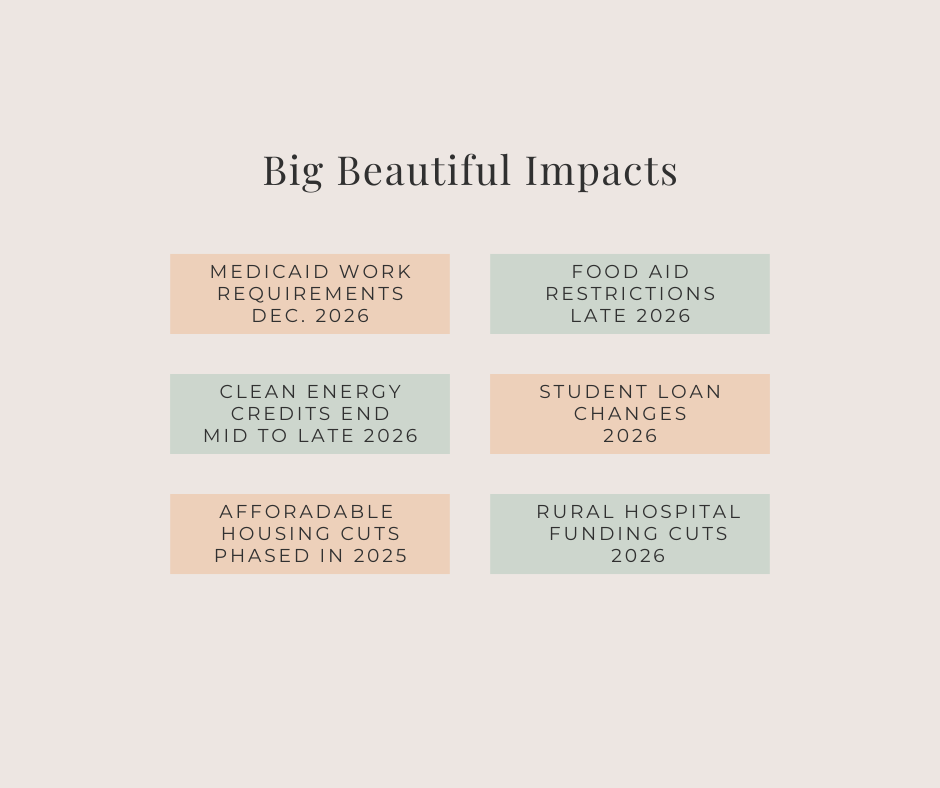

Some key domestic program dates (highlighted SNAP/hunger figures) to be mindful of are:

Immediately: The Department of Agriculture is barred from updating standards for the SNAP Thrifty Food Plan for several years and cannot increase its value beyond inflation.

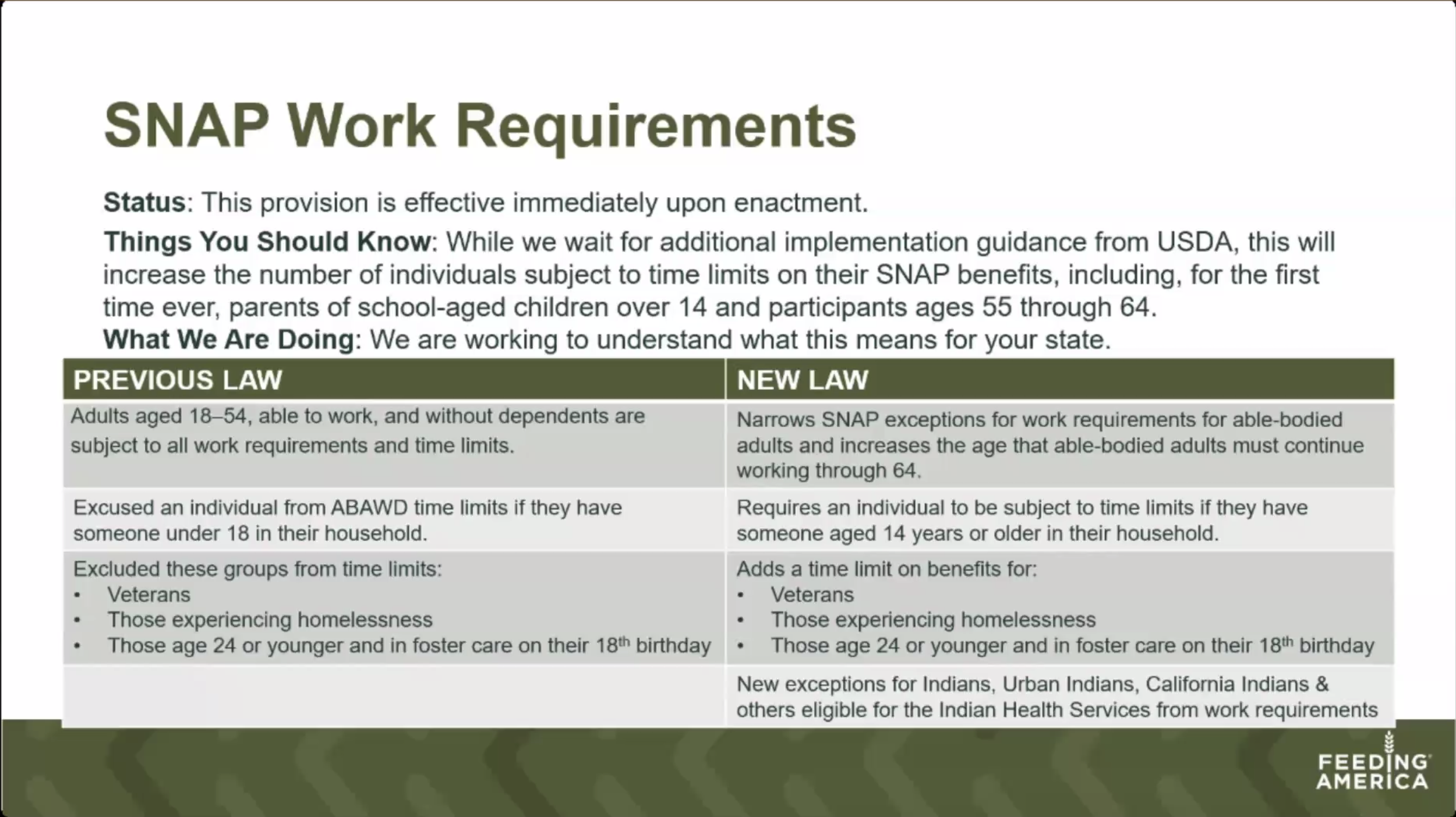

Immediately: New SNAP work requirements are imposed on Abled Bodied Adults without Dependents (ABAWDS), raising the max age from 54 to 64, and now including families with children over 14. States are barred from waiving these requirements during economic turbulence.

Immediately: Several HHS rules designed to increase access to Medicaid, Medicare, and CHIP child healthcare funding are frozen until 2034.

October 2025: Due to large increases in the national deficit, without further action from Congress, possible sequestration could force the Office of Management and Budget to begin cuts to Medicare funding, due to Statutory Pay-Go rules.

December 2025: Affordable Care Act subsidies are allowed to expire, likely increasing insurance costs nationally.

October 2026: States are now expected to pay 75% of SNAP administration, raised from 50%.

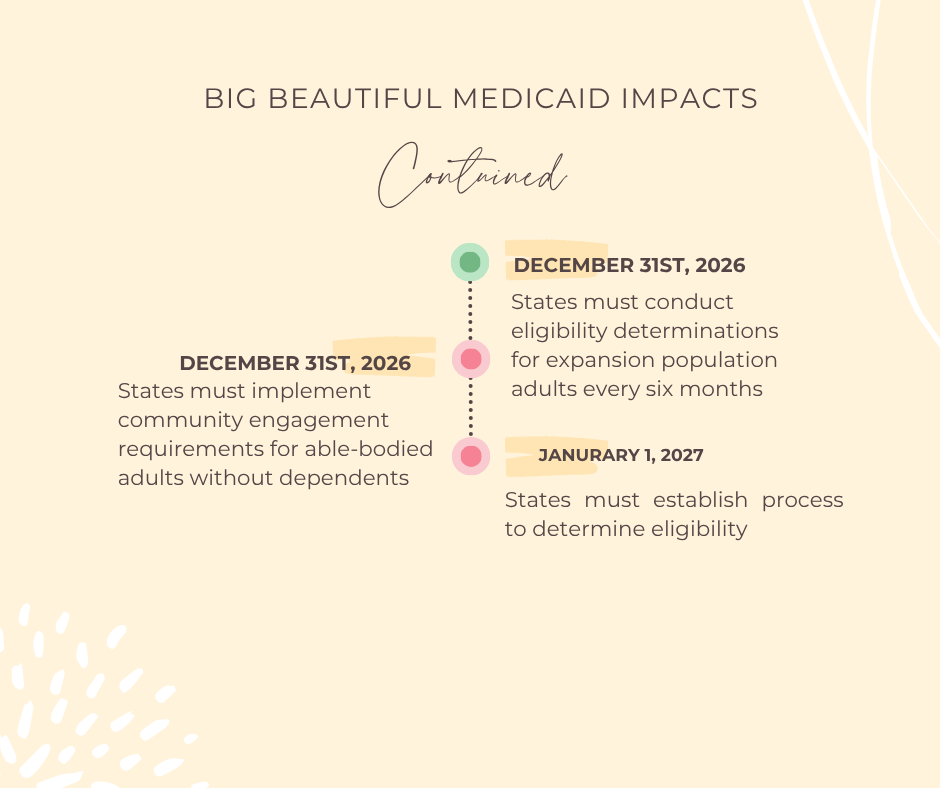

December 2026: New Medicaid work requirements are imposed on ABAWDS, with new required check-ins every six months.

October 2027: States are required to pay 0-15% of the cost of SNAP benefits, based on their FY25 or FY26 payment error rate. Certain states with the highest payment error rates are exempt until late 2028 and late 2029.

October 2027: States capped on taxing certain health providers to 5.5%, gradually phasing down to 3.5% by 2031. Provider taxes are a core means of funding state Medicaid contributions, which will create a fiscal challenge for expanded Medicaid states. Meanwhile, states are now required to pay 5-15% of SNAP benefit costs in their state, depending on their administrative error rates.

October 2029: Deadline for states to have built new Medicaid address systems designed to reduce individuals from participating in multiple Medicaid programs.

2032: Social Security and Medicare are now estimated to be insolvent, due to increase in the federal debt.

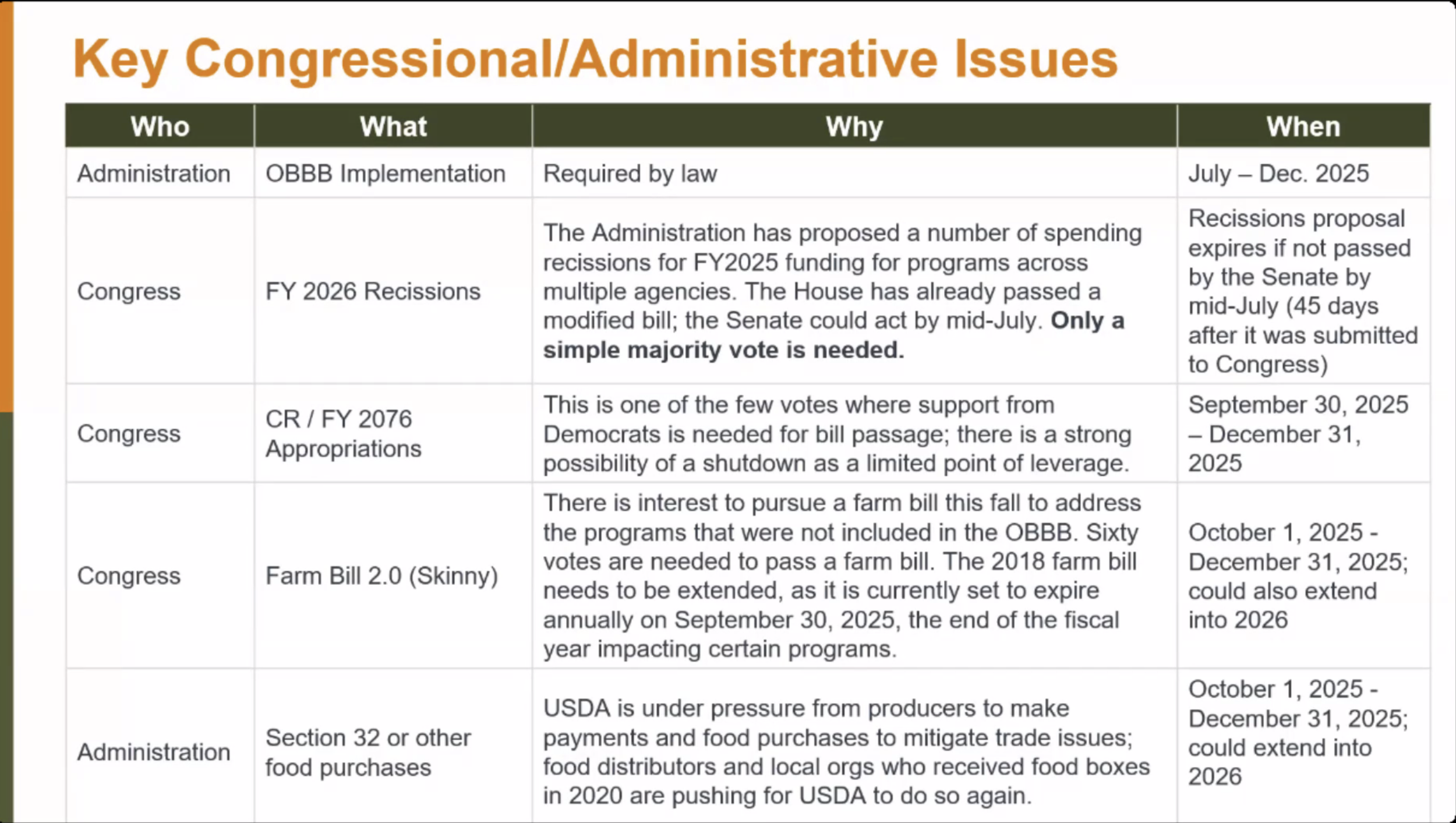

Federal Budget: The House and Senate appropriations committees are advancing their annual appropriation bills. Though the House committee-advanced agriculture spending bill included cuts to the Women, Infants and Children program, the Senate full funded the measure and other rural development accounts. Lawmakers must past a budget by the fiscal deadline of Oct. 1 or risk a government shutdown.

"Skinny" Farm Bill Advancing: Several major commodity and price setting provisions of the Farm Bill were included in the One Big Beautiful Bill Act. Chairman Glenn Thompson (R-PA) of the House Agriculture committee has since said that he is interested in passing the rest of the Farm Bill ASAP in the fall - though social capital with House Democrats have soured since defunding much of the nutrition title and SNAP. https://frac.salsalabs.org/update-18july2025?eType=EmailBlastContent&eId=2e3d1a76-c4c1-436c-8ad9-a424e185e046

Graphics below courtesy of Feeding America via our colleagues at Arizona Food Systems Network.